Size Matters

Through much of my career in the bond market bigger truly was better. Nobody was bigger or better than Bill Gross of PIMCO. His bond fund was mammoth and if you had something worthwhile to sell, one call to Big Bill was all that was needed to get the deal done. He was legend, true or not.

Big Bill also had quite a tail wind. As the bond bull market began to gather momentum in the early 1980’s, Big Bill was ready. He knew performance would drive growth in assets and he knew the kinds of bonds that would perform well. His record speaks for itself.

During a bull market there should be little reason to sell. I am sure Big Bill culled some of his mistakes from his portfolios through the years, but largely one can buy and hold and never need to sell. Worthwhile performance led to growing assets and more funds available. Eventually the bond matures and this will only add to the money he continued to attract for decades.

Scaling from a small operation to a multi-trillion dollar behemoth, Big Bill and PIMCO, had a plan and executed it. He is more than worthy of the title Bond King. Needless to say his success has been studied and will continue to be studied as a great success in money management.

Big Bill no longer manages the PIMCO assets he built over several decades. Nor does he work with Janus Henderson, the firm he joined in 2014 when he left PIMCO. Earlier this year Big Bill hung it up.

What happened? The end of the bond market bull market is what happened, in my opinion. Scalability in a rising, growing market is a win, win, win for investors, performance and profits. In such a world there is no such thing as too big. Whether Big Bill managed one, two, ten or even more trillion dollars in bond assets, in the midst of a thirty-plus year bull bond market, all would be good!

Big Bill is obviously a smart person. Therefore he would know thirty-year old bull bond markets will not continue forever. Managers have a choice: pretend that a long-term trend will continue or begin planning to take a different tact.

Long-time readers remember we called the end of the bond bull market in late 2012. I made this call with somewhat less than Big Bill’s trillion dollars at stake. But I don’t think it was any coincidence that in a matter of months Big Bill left PIMCO to basically start afresh a Janis Henderson.

As a bond picker, Big Bill knew the bonds he had chosen during the bond bull market would work against him post bull market. Those bonds needed to be sold and when you are the big fish in the pond, this is problematic. Better to let PIMCO manage PIMCO’s bonds than attempt to restructure a trillion plus dollar bond portfolio. Besides, PIMCO may have felt too committed to the bond bull to change course, particularly as dramatic as a call of the end of the bond bull market would portend.

Starting over at Janus Henderson Should have worked for the Bond King. No longer burdened with trying to sell bonds whose performance may drag you down, Big Bill could concentrate on selecting bonds he thought would perform going forward. This is a huge advantage, yet it too failed.

The problem lies with scalability. Size matters. Almost all of Big Bill’s Janus funds assets were invested in corporate and mortgage securities. Yes, he could presumably scale his investments in those assets, but no, those assets do not offer worthwhile selections for an ongoing bear market. Big Bill moved to Janus in 2014 and we are very aware of how slow this bear bond market is unfolding. An asset manager needs performance year in and year out, something that even the Bond King would have difficulty delivering with corporate and mortgage securities. Big Bill retired in March, after posting mostly pedestrian performance figures for his fund at Janus over the past four years.

Scalability works in a bull market, it does not work in a bear market. Bigger was better in bonds, but those days are over and have been for several years. Size matters and in a bear market, the size that works will undoubtedly be smaller, if not downright small.

This is the basis for the performance at The Select ApproachTM these past years. Opportunities do not go to the biggest and fastest growing asset manager in a bear market; there are no opportunities involving size. Sure, big trades change hands from one optimistic manager to another optimistic manager, but these are only trades. We do not want to own those bonds long term because they will not perform in a bear market.

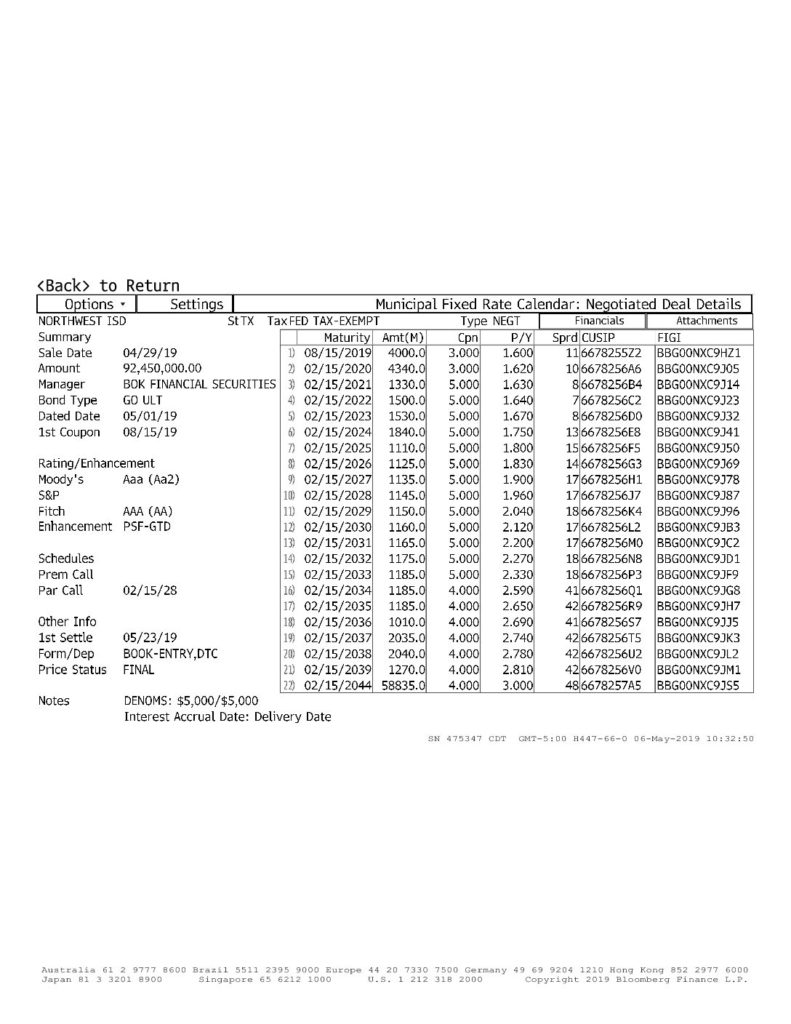

We find opportunities where others do not. Great bond managers have an eye for future performance whether in a bond bull or a bond bear. But you have to have the right assets, and for us the municipal bond market provides fertile ground to find these bonds that we believe have a good chance to perform. Can we scale up to trillions? No, but we don’t need to or want to. It is a bear bond market. We only need to scale for you, and that’s our focus.

Recently Big Bill sat down for an interview with Bloomberg after announcing his retirement. He said he would be investing in municipal bonds. Yes Big Bill!

Brokerage services are provided by Maplewood Investments, Inc., MEMBER FINRA, SIPC. The Dow Jones Industrial Average, NASDAQ Composite, S&P 500, Russell 2000, MSCI World ex-USA, and MSCI Emerging Markets are unmanaged indexes. An investment cannot be made directly in an index. It should not be assumed that past performance in any way relates to future results. The information herein has been derived from sources believed to be reliable, but this is not a guarantee as to the accuracy and does not purport to be a complete analysis of the security, company or industry involved. Since no one investment program is suitable for all types of investors, you should carefully consider the investment objectives, risks, charges and expenses. Additional information is available upon request. The opinions expressed in this herein are the opinions of Kurt L. Smith only. They are not the opinions of Maplewood Investments, Inc., or its officers or employees.

NEWS FEED